What is underinsurance?

Underinsurance means that the risks of a business are greater than what their insurance can cover.

Being underinsured means you will likely not be fully financially covered if a disaster were to happen to your business or property.

This can easily be calculated using the underinsurance formula.

(Policy Sum Insured/Correct Sum Insured) x Claim = Payment

Although the underinsured party’s sum insured often way exceeds of the claim amount, they would be left with a shortfall.

Therefore the underinsured party will have to cover for this shortfall by paying out of their own pocket.

Why is it important to know the dangers of underinsurance?

Download our underinsurance whitepaper to learn about recent developments and how you could be at risk.

Inflation and Underinsurance

Rising inflation is impacting prices across all sectors, including insurance. Following a claim, costs will be much higher than expected, potentially leaving commercial businesses underinsured.

According to The Office of National Statistics, The Consumer Prices Index rose by 6.2% in the 12 months to February 2022, up from 5.5% in January. On a monthly basis, CPI rose by 0.8% in February 2022, compared with a rise of 0.1% in February 2021 – the largest monthly CPI increase between January and February since 2009. The conflict in Ukraine is, no doubt, fuelling inflation; demand for materials has risen considerably as Eastern Europe supply lanes are sectioned-off. The backlash from COVID-19 has also had an impact, causing factory closures, worker absences and container shortages.

Such materials increasing in value include metals, electronics, oil, steel and copper. This is just one of the factors that drastically affect the valuation of companies, as the storage of these materials expose the companies at risk of underinsurance. It also results in damages expenses being greater as the cost to rebuild buildings has increased – with both labour shortages and materials increasing in price.

Businesses need to counteract the consequences of inflation by contacting their broker. At Romero Insurance Brokers, we will exact an accurate up to date valuation of your company. Together, we will avoid the dangers of being underinsured in the event of a claim, with your finances safeguarded against the condition on average rule.

Contact Romero Insurance Brokers today to learn more about the consequences of inflation and to receive an accurate valuation.

Listen to the Underinsurance Podcast

Technical Claims Manager, Stuart Dobbins details the recent changes to the insurance market and how it could put you in danger of being underinsured.

For more from the Romero Expert Insights podcast series, see here.

Download our Underinsurance Whitepaper

What are the recent developments affecting your risk of being underinsurance? Our whitepaper covers everything you need to know.

Download now

High Net Worth individuals and Underinsurance

Why high net worth individuals should read their insurance policies today?

Learn from the experts

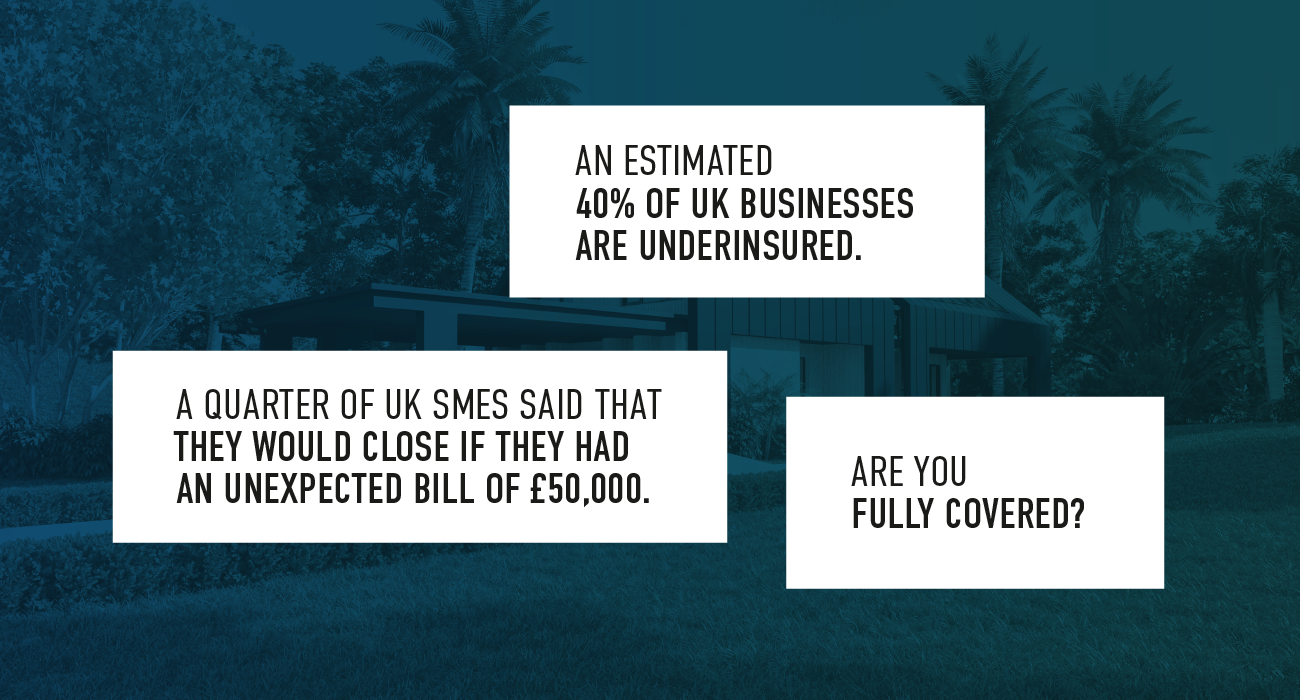

SMEs risk the dangers of Underinsurance

Many SMEs (small to medium-sized enterprises) have been tempted to reduce their cover, cutting a range of insurance policies, and becoming dangerously underinsured.

Find out the dangers today